ছবি: ছবি: সংগৃহীত

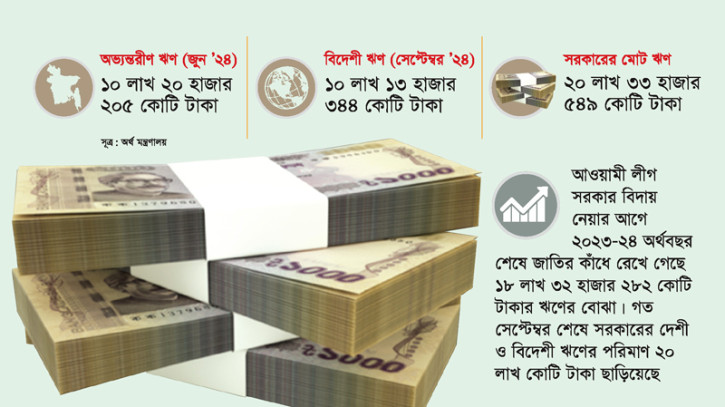

The government’s debt has exceeded 20 lakh crore taka by the end of September last year. Of this, foreign debt amounted to 8,444 crore 54 lakh dollars, which, at an exchange rate of 120 taka per dollar at the time, translates to 10 lakh 13 thousand 344 crore taka. The remaining portion of the debt is internal. Economists have expressed concerns that, in comparison to revenue generation and foreign income, the level of debt has become alarming. They suggest that without effective debt management strategies, the country could face a severe crisis in the future.

Bangladesh ranks among the lowest in the world in terms of revenue collection relative to its GDP. The income from exports and remittances has also fallen short of expectations. Meanwhile, government expenditure continues to rise year after year. To meet this rising expenditure, the government has taken on increasing loans, both domestic and foreign. Additionally, corruption and money laundering have been reported in connection with the borrowed funds. Following the mass uprising in August, the interim government inherited a heavy debt burden.

According to the Ministry of Finance, before the Awami League government left office, the debt burden at the end of the 2023-24 fiscal year was 18 lakh 32 thousand 282 crore taka. Of this, internal debt amounted to 10 lakh 20 thousand 205 crore taka, and foreign debt stood at 8 lakh 12 thousand 77 crore taka.

During Sheikh Hasina's nearly fifteen-year rule, the size of the national budget has increased significantly. However, government bank loans have inflated even more than the budget itself. According to data from the Ministry of Finance, in the 2009-10 fiscal year, the government’s total debt from domestic and foreign sources was 2 lakh 76 thousand 830 crore taka, of which 1 lakh 61 thousand 20 crore taka was foreign debt, and the remaining 1 lakh 15 thousand 810 crore taka was internal debt.

Economists argue that while the country’s debt level has been continuously rising, the borrowed funds have not been used efficiently. There have been instances of corruption and money laundering, and some projects funded by loans have yielded little or no returns. If the borrowed funds are not invested in productive sectors, the country’s ability to repay its debts will diminish over time.

Dr. Mustafa K. Mujeri, former chief economist of Bangladesh Bank and executive director of the Institute for Inclusive Finance and Development (INM), commented to Bonik Barta, saying, "With the depreciation of the taka, the amount of foreign debt in local currency will continue to rise. Alongside, the overall debt has increased. If we continue borrowing at this rate, our debt will keep increasing. The important question is whether we will have the capacity to repay the loans. If we use borrowed funds in productive sectors, our repayment capacity will improve. However, if the funds are misused, repayment capacity will decrease, leading to a situation where we may not be able to repay at all. There have been cases of corruption and money laundering related to loans taken for projects in the past. The existing loans are already taken, so there is little that can be done now. However, ongoing projects funded by loans need to be properly executed to achieve the desired results. If that happens, our ability to repay debts will improve. For new loans, we must ensure that they contribute to enhancing productivity, which will help us meet repayment obligations."

Under the previous Awami League government, the national budget size grew every year, especially due to infrastructure development and mega projects. However, revenue collection did not increase correspondingly. Tax exemptions and various benefits were granted for group interests, resulting in revenue losses. As a result, to implement the massive budget, the government became increasingly dependent on both domestic and foreign borrowing. Additionally, by accepting foreign assistance, the country had to comply with foreign conditions, thereby limiting its ability to formulate independent economic policies.

For the fiscal year 2024-25, the ousted Sheikh Hasina government declared a budget of 7 lakh 97 thousand crore taka, with a revenue target of 5 lakh 41 thousand crore taka and a deficit of 2 lakh 51 thousand 600 crore taka. This deficit was to be met by borrowing from both domestic and foreign sources. The budget included a development expenditure of 2 lakh 81 thousand 453 crore taka, with the Annual Development Program (ADP) set at 2 lakh 65 thousand crore taka. The current interim government has made minimal changes to the budget proposed by the previous government. Although the budget size is expected to shrink slightly, the recent increase in interest rates poses a new concern. This could lead to record-high interest payments by the end of the fiscal year.

The National Board of Revenue (NBR) has not yet released the revenue collection data for November and December. In the first four months of the fiscal year (July-October), the NBR collected 1 lakh 1 thousand 281 crore taka in revenue, falling short of the target of 1 lakh 32 thousand 114 crore taka. The average monthly revenue collection during this period was 25 thousand 320 crore taka. This represents a 1% decrease in revenue collection compared to the same period last year.

Despite revenue collection failing to increase, government expenditure continues to rise, leading to an increased dependence on loans. Currently, most of the government's revenue income is being used to pay off loans and interest on loans. Under the ongoing loan program, the International Monetary Fund (IMF) has set a revenue target of 4.5 lakh crore taka for Bangladesh in the current fiscal year. However, economists and businesspeople are skeptical about the country's ability to meet this target due to the challenging economic and business environment. In the meantime, the government has increased VAT and customs duties on a range of products to raise additional revenue.

In recent years, the government's debt and the burden of debt repayment have significantly increased. According to projections from the Ministry of Finance, the debt repayment for the fiscal year 2024-25 will exceed all previous records. The government will need to repay 3.5 lakh crore taka in principal and interest payments. Additionally, 1 lakh 13 thousand 500 crore taka was allocated in the budget for interest payments, but the actual interest payments are expected to be even higher. As a result, by the end of the fiscal year, the total debt repayment could reach 4 lakh 73 thousand crore taka. This year, the government is expected to make the highest debt repayment to date, and the repayment burden is expected to remain high through the 2028-29 fiscal year.

Economists are emphasizing the importance of comparing the country's debt with its GDP to assess the debt burden. However, there are concerns about the accuracy of Bangladesh's GDP figures. Even though Bangladesh's debt may appear low compared to its GDP, the country is facing challenges in repaying it due to an economic crisis. Therefore, evaluating the debt risk in relation to revenue generation, exports, and remittance flows has become critical.

Dr. Zahid Hossain, former chief economist of the World Bank’s Dhaka office, told Bonik Barta, "According to the IMF and World Bank, the total debt should not exceed 55% of GDP, with foreign debt constituting no more than 40%. Based on the government’s calculation, the debt has been rising faster than GDP. If this continues, the debt-to-GDP ratio will soon surpass the 55% mark. This could happen even sooner due to concerns over the accuracy of GDP figures. While Bangladesh’s debt-to-GDP ratio may still be within safe limits, our reliance on foreign debt has grown significantly. The increasing debt burden, along with the country's ongoing revenue shortfalls, requires urgent attention."

reporter